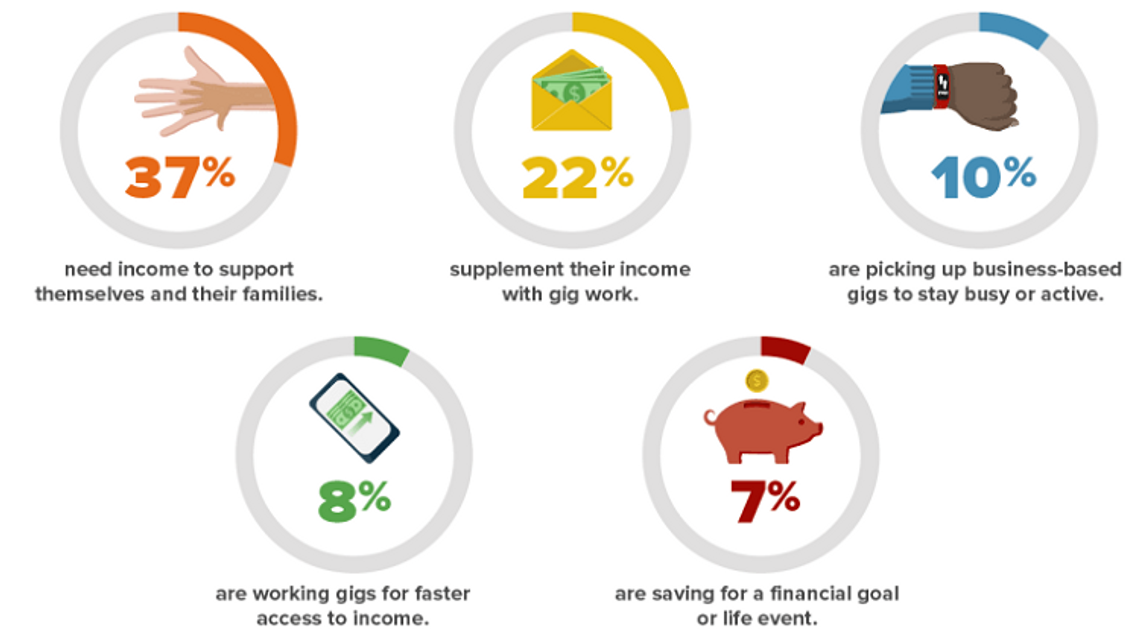

Are you a “gig” worker? If so, you’ve got a lot of company – by some estimates, more than a third of U.S. workers participate in the gig economy as freelancers, independent contractors or moonlighters. And while gig work offers some attractive features, such as flexibility in setting your hours and no real limits on your income potential, it also comes with challenges. Specifically, you may miss out on the array of benefits available to full-time employees of many organizations. How can you fill this benefits gap?

Let’s look at some of the standard employer-offered benefits and ways you can acquire them on your own:

* Retirement plan – When you work as an employee, you may have access to an employer-sponsored retirement plan. These types of plans allow you to save for retirement in a tax-advantaged way. As a gig worker, you may be able to get these same benefits through your own retirement plan. You can always contribute to a traditional or Roth IRA, but you can invest much more in other types of plans, such as a SEP IRA, a SIMPLE IRA, and possibly even a “solo” 401(k). A financial professional can recommend a plan that’s suitable for your situation.

* Life and disability insurance – Many employers offer life insurance as an employee benefit, and while this coverage may not be sufficient, depending on one’s family situation, it’s at least something. But as a gig worker, you’ll need to get your own life insurance, which is essential if you have anyone depending on you for financial support. You may also want to look for disability insurance to replace part of your income should you ever become temporarily unable to work due to illness or injury. It’s worth noting that some organizations for freelancers and self-employed individuals offer access to life and disability insurance, so you might want to do some research online to check out these groups.

* Health insurance – As you know, health insurance is always a pretty big issue for just about everyone, regardless of their work status. Of course, many mid- to-large-size employers offer health insurance to their employees, but as a gig worker, you’ll need to find your own, unless you’re covered by your spouse’s plan. In looking for health insurance, you may want to contact a “navigator,” the position created by the Affordable Care Act (ACA) to help individuals find coverage. You can find someone in your area by going to healthcare.gov and following the prompts. Depending on your income, you may be able to receive subsidies through the ACA.

* Paid time off and unemployment insurance – Many full-time employees are given paid time off for sick leave and vacation. They may also receive unemployment insurance if they lose their job. Since most gig workers won’t have access to these benefits, it’s important to have an emergency fund available for unexpected (or even expected) income dips. Ideally, you’d want three to six months’ worth of living expenses in your emergency fund, but even a few hundred dollars can help create a lot more security to cover life’s unexpected events.

Full-time employees receive something of great value in their benefits packages. As a gig worker, you’ll have to take the initiative to close this benefits gap – but the opportunities are there, so do what you can to find them. It will be worth the effort.

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor. Edward Jones, Member SIPC

Comment

Comments