If you’ve noticed an increase in bicycle-related events lately, it may be because May is recognized as “Bike Month” – and some cities even observe a specific Bike Week. Of course, bicycling is good exercise and an environmentally friendly method of transportation, but it can also teach us some lessons about investing.

Here are a few to consider:

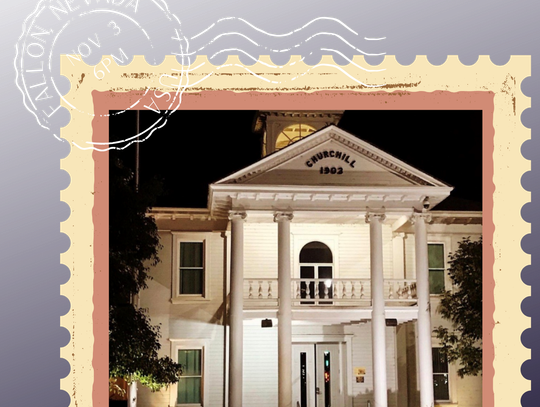

Put the brakes on risky moves. To keep themselves safe, experienced cyclists regularly do two things: They keep their brakes in good shape and they don’t take unnecessary risks, such as whipping around blind curves. As an investor, you can combine these two actions by putting your own “brakes” on risky moves. For example, if you’re tempted to buy some hot investment you heard about, you may want to think twice before acting. Why? In the first place, most “hot” investments don’t stay hot for too long and may be cooling off by the time you hear of them. And even more important, they might not be appropriate for either your risk tolerance or your need to diversify your portfolio. When you invest, you can’t eliminate all risks, but you can reduce them by avoiding impulsive moves and sticking with a disciplined, long-term strategy based on your needs and goals. Get regular financial tune-ups. Avid cyclists keep their bikes in good shape through regular maintenance. When you invest, you usually don’t need to make a lot of drastic moves, but you should periodically “tune up” your investment portfolio, possibly with the help of a financial professional, during regular reviews. Such a tune-up may involve any number of steps, but the main goal is to update your portfolio so it reflects where you’re at in life – your goals, risk tolerance, earnings and family situation. Protect yourself from bumps in the road. All serious bicyclists – and all bicyclists serious about keeping their heads intact – wear helmets when they are riding, because they know the dangers of rough terrain. Likewise, you need to protect yourself from the bumps in the road that could impede your progress toward your objectives. For starters, life insurance can help your family meet some essential needs – pay the mortgage, educate children, and so on – in case something were to happen to you. And you may need disability insurance to replace your income temporarily if you became injured or ill and can’t work for a while. Also, you might want long-term care insurance, which can help you guard against the potentially catastrophic costs of an extended stay in a nursing home or the services of a home health care worker. Don’t stop pedaling. When going long distances, bicyclists ride through rain, wind, sun and mosquitoes. They elude angry motorists and they change flat tires. In short, they persist in reaching their destinations. As an investor, you will pursue some goals that you may not reach until far in the future, such as a comfortable retirement, so you too need to demonstrate determination and persistence by continuing to invest, in good markets and bad, through unsettling political and global events – and even despite your own occasional doubts. Whether you’re an avid cyclist or not, following these principles can help keep your financial wheels moving along the road to your goals. This article was written by Edward Jones for use by your local Edward Jones Financial Advisor. Check the community calendar for all the exciting events happening in Fallon this weekend. Support local, independent news – contribute to The Fallon Post, your non-profit (501c3) online news source for all things Fallon. Never miss the local news -- read more on The Fallon Post home page.

Comment

Comments